| Macroeconomic Consequences The decision to remove the American dollar from bimetallism in 1873 did not have immediate consequences,

for, as we've seen before, silver was undervalued at the legal

ratio and nobody used it anyway. But as one country after the other switched to the Gold Standard at the end of the century, the

demand for gold rose tremendously and a flow of silver was freed from monetary purposes in

France, England, Germany and most other big countries. (More

on this).

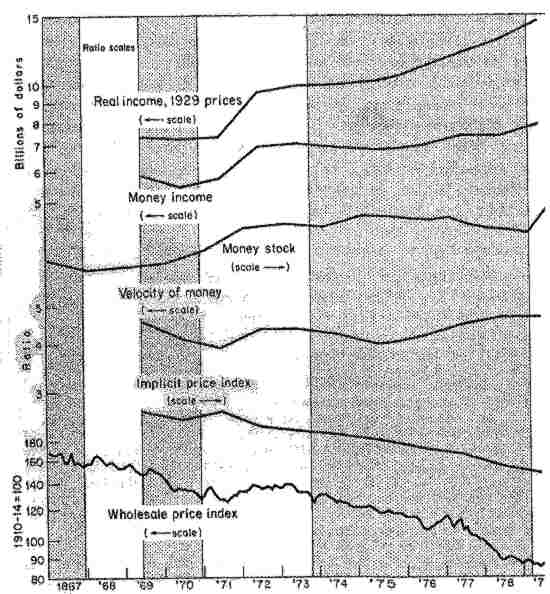

The result was that the dollar (and so the American

monetary mass and ultimately output and employment) was linked to a metal that was getting

scarcer and scarcer, because between 1879 and 1897 the rate of increase in gold output

slowed, and the demand increased at the same time. The monetary mass could not keep pace

with the strongly expanding economy, and price measured in gold declined strongly. This

deflationary effect was hindered to some extent by the spreading monetization of the

American economy and a more efficient banking system that allowed to pile up more paper

money on a given currency base (that is, gold). (more on this)

We see between 1875 and 1896 a deflation of about 1% a year in the general CPI. A the same time the output rose by 6 % a year.

Economists reader should not say, <<Gee what a growth even with those declining

prices!>>. It's precisely this growth that made the prices go down. With a

fixed quantity of money if the number of transactions rises and the velocity cannot rise

sufficiently, then prices have to fall.

All this led to a depression so great that you would

have to wait for 1932 to see the same again. Unemployment peaked at 18 % in 1894. But some

people suffered more than others (more on this).

On the monetary side, this deflation made many bank loans

turn sour, as the debtors struggled to honor their obligations with rising real value of

their debts. Some famous banking panics occurred (1892) , but globally the trust of the

public in the banking system increased. The ratio of deposits to reserves rose from 2 to 4

at the end of the period.

Next slide

NB : By clicking on words in the commentary, you will

be taken to the glossary where I have defined most of the specialized terms for you.

Please use your BACK button to come to the original page. |